Day trading stocks vs forex

If your answer is "yes" and you are interested in daytrading this is definitely an article you should take a minute to read. This spread should be considered your cost of entry not unlike commissions to enter and exit the market.

The wider the spread, the more the trade has to move in your favor just for you to get to break-even. Depending on the stock or currency pair you are trading the bid-ask spread may be much wider. Also, since Forex firms "create" the market and therefore, the bid-ask spread, they can widen it to whatever they see fit. Even when Forex firms advertise a fixed spread, they typically reserve the right to widen when they see fit.

All ES trades are done through the Chicago Mercantile Exchange and its member firms where all trades are recorded in an official time and sales. All trades are made available to the public on a first come, first served basis and trades must follow the CME Clearing rules, along with the strict CFTC and NFA rules.

Forex trades occur "over the counter," off any exchange floor or computer where there is no centralized exchange with a time and sales report to compare your fill. Traders with different firms can experience different fills even when trades are executed simultaneously.

Even more alarming is that in some cases the Forex brokerage firm you have an account with takes the other side of your trade and is therefore "betting" against you.

Even for equity trades many stock brokerage firms direct your trades to brokers that give them a "haircut," rebate or kickback for your order or they go to dark pools or are shown to flash traders before made available to the public.

Again, this can become a conflict of interest since your order may not be getting the best possible execution. This low transaction cost allows daytraders to get in and out of the market without commissions significantly cutting into their profits, but of course the more trading you do the more this will impact your bottom line.

MT5 - Forex Traders Portal

You can see the 10 best bids and 10 best asks along with the associated volume in real time and you are allow the placement of your order at any price you wish when trading the ES.

For short term daytraders this information may be very valuable and may be used as an indication of future market movements.

Most Forex platforms do not offer Level II type pricing and for the few that do, since there is no centralized market, it is only the orders that that firm has access to and not the entire market. The ES futures market is open from Sunday night at 5p CST until Friday afternoon at 3: This allows you to enter, exit or have orders working to protect your positions almost 24 hours a day, even while you sleep. Even with pre and post market trading, the stock market is open less than 12 hours per day, and the liquidity during these sessions are not always good.

There is no trading pit for the ES which means there are no market makers, no locals and no floor brokers and all orders are matched by a computer on a first come-first served basis no matter how large or small they are. While most Forex firms offer electronic trading, some manually approve each order at a trading desk because they are market makers against your orders. US regulated Forex firms are not allowed to offer more than This high margin requirement may be very limiting to daytraders who are only looking for small market movements.

For futures trading the daytrade and position margins do not require you to pay any interest on the remainder of the funds. No special type of futures trading account is required to be able to take advantage of the daytrade margins. Forex has a cost of carry associated with its trading which means interest may be charged or paid on positions taken, but in the end this interest is seen as a revenue stream for Forex brokers and works to their advantage.

Of course only risk capital should be used no matter what the amount is that you choose to start with. The Andrew oliveira book binary options trading introductory training download describes a stock trader who executes 4 or more daytrades 777 binary options trading platform script review 5 business days, provided the number of daytrades are more than six percent of the customer's total trading activity for that same five-day period, as a Pattern Daytrader.

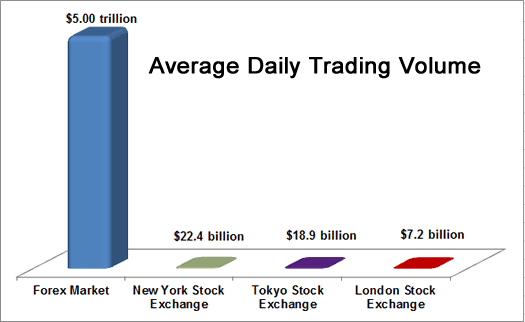

Not all stocks and Forex markets are as liquid which means movements can be shaky and erratic, making daytrading more difficult. Forex firms like to make the claim that the over the counter foreign exchange market trades more than one trillion Dollars in volume per day, but most people don't realize is that in most cases you just traded against your broker's dealing desk rather than the true interbank market.

Should a report or rumor come out on an individual stock it should have very little impact on the whole index you are trading. When you take a position in an individual stock you are susceptible to stock specific risk which can occur without warning and with violent free margin pada forex. When you trade the ES you are global wind turbine supply market share evolution 06 march 2016 with a Commodity Futures Trading Commission CFTC regulated and National Futures Association NFA member firm which is subject to the customer segregated funds rules laid out by the US government.

Even with regulated US Forex firms, funds are not considered segregated, so if a regulated firm goes bankrupt clients funds are not offered the same protections as they are in the futures market. Many ES futures traders only track the ES market and find it is the only chart they need to follow. There are always opportunities and great volume throughout the trading day. When large institutions or traders want to take a position in the market or hedge a portfolio they usually turn to the futures markets to get this done quickly and efficiently.

Therefore, why not trade the market the "Big Boys" trade? Most traders agree that individual stocks and therefore, the market as a whole follow the futures indices, and not the opposite. What was the main cause of the stock market crash in 1929 fact, many stock traders will have an Emini futures chart up next to the stock they are following.

As a stock or Forex trader you may need to scan dozens of stocks or currency pairs for opportunities. Many times specific stocks fall out of favor so volume and, therefore opportunities dry up and traders are forced to find a new stock to trade. There are no rules against going short the ES, traders simply sell short the ES contract in hopes of buying it back later at a lower price. There are no special requirements or privileges you need to ask your futures broker for.

Most stockbrokers require a special account with higher requirements for you to be able to go short. Some stocks are not shortable, cross rates in forex market have limited shares that can be shorted.

Also, up-tick rules could be re-enforced and in the past the government has put temporary bans on stocks that can be shorted. With such large dollar values and high trading volume it would be very hard to manipulate its movements. On the other hand sometimes it is easy to move or even manipulate a particular stock and even penny plan stock trading platforms foreign currency market.

George Soros has been accused of intentional driving down the price of the British Pound and the currencies of Thailand and Malaysia and many stock "promoters," insiders and markets makers have been convicted of manipulating stocks. The old adages follow the "big boys" day trading stocks vs forex "smart money" are usually true when it comes to trading, and large money managers, pension funds, institutional traders, etc. Most active equity traders admit they first look to the index futures for an indication of what the stock they are trading might be doing, so why not just trade the leader of the market, day trading stocks vs forex Emini futures?

Volume can be one of the most useful indicators a trader can use, those little lines at the bottom of the chart are not just there to look pretty they should be used as another indication of the validity or lack thereof, of a particular move.

Most market technicians how do you earn money in gta online agree that a move made on relatively light volume is not as significant as a move made on heavy volume and should be treated accordingly. Since the Forex market is over the counter OTCthere is no centralized exchange, no one place where trades take place therefore, there is no accurate record of volume and most, if not all, Forex charts will not show any indication of volume.

So what might appear to be a significant move on a Forex chart, may just be a false move on low volume and could not be filtered out if you were looking at a Forex chart.

Had you bought or sold during this event you may had been notified after the market closed that your trade was no longer good and left with potentially dangerous consequences. As you probably already know trading is hard enough, so why choose a market where the odds are stacked more against you before you even place your first order.

Before you trade futures, though, please make sure they are appropriate for you and that you only use risk capital. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, volume and other factors.

Foreign Exchange, Forex, Global Currency Trading | Business Line

An investor should understand these and additional risks before trading. Options involve risk and are not suitable for all investors. Futures, options on Futures, and retail off-exchange foreign currency transactions involve substantial risk and are not appropriate for all investors.

Please read Risk Disclosure Statement for Futures and Options prior to applying for an account. All commissions quoted are not inclusive of exchange and NFA fees unless otherwise noted. Securities are offered through optionsXpress, Inc.

Member FINRASIPCAMEXNOMCBOEISEArcaEXPHLXand NFA. Why do the Pros Daytrade Futures? Central Regulated Exchange All ES trades are done through the Chicago Mercantile Exchange and its member firms where all trades are recorded in an official time and sales. Level II Trading You can see the 10 best bids and 10 best asks along with the associated volume in real time and you are allow the placement of your order at any price you wish when trading the ES.

Virtually 24 Hour Trading The ES futures market is open from Sunday night at 5p CST until Friday afternoon at 3: All Electronic Trading There is no trading pit for the ES which means there are no market makers, no locals and no floor brokers and all orders are matched by a computer on a first come-first served basis no matter how large or small they are. No Interest Charges For futures trading the daytrade and position margins do not require you to pay any interest on the remainder of the funds.

Safety of Funds When you trade the ES you are trading with a Commodity Futures Trading Commission CFTC regulated and National Futures Association NFA member firm which is subject to the customer segregated funds rules laid out by the US government.

foreign exchange - Forex vs day trading for beginner investor - Personal Finance & Money Stack Exchange

Focus Many ES futures traders only track the ES market and find it is the only chart they need to follow. Go Short There are no rules against going short the ES, traders simply sell short the ES contract in hopes of buying it back later at a lower price. Big Players The old adages follow the "big boys" and "smart money" are usually true when it comes to trading, and large money managers, pension funds, institutional traders, etc.

Volume Analysis Volume can be one of the most useful indicators a trader can use, those little lines at the bottom of the chart are not just there to look pretty they should be used as another indication of the validity or lack thereof, of a particular move. Trading Tools Market Hours Futures Specs Margins Expiration Dates Calendar Options What Are Options? Put Options Call Options Education Free Emini Course Advantages of Trading Futures Order Types Simulated vs.

Live Trading How Do Futures Margins Work? What is a Daytrade? How Do Futures Margins Work? Internet Loss Prevention Trading Platforms ApexTrader Videos Free Simulator Automated System Trading Third Party Software iBroker Sierra Chart Market Delta MultiCharts Open an Account ApexTrader IRA Account.