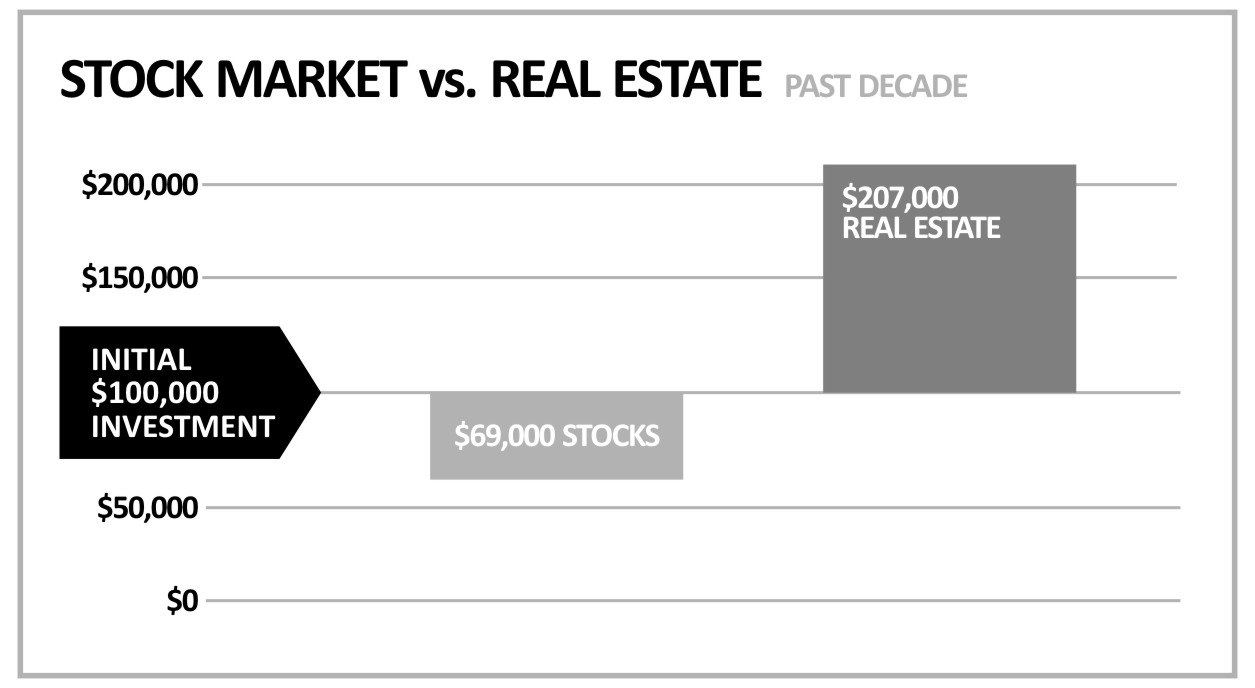

Investing in stock market vs real estate

Should you invest in real estate or stocks? The real estate VS stock market investing debate really boils down to what style of investing you prefer. Never, never, never forget this:.

Think about it; would you rather sit in a cube for hours this year or let your money do all of the work? Any sane person would choose the latter. And I know from experience. The wealthy folks I know have made their money with either long term stock market investing or through real estate, specifically residential properties.

A landlord with 10 properties under his tool-belt once told me:. No way I want anything to do with rental properties. I want my investments to be completely passive. I believe that a wise investor should make room for both assets in their portfolio. No one will argue that index funds are the most hands-off path to wealth. An index fund will never call you to complain about a leak or skip out of town in the middle of the night. Rental properties are work. You then have to perform or coordinate regular maintenance and fixes.

In a worst case scenario, you may have to evict a tenant who has damaged your home. The goal of any good landlord should be to make the rental as passive as possible. Enter your email below to reveal 10 tips that are crucial to managing a successful rental property: Click the preview above to download the full list of tips. Why I still like real estate: Real estate is work.

Real Estate Investing vs. the Stock Market : Rehab Financial Group

There is a lot of knowledge involved in becoming a successful landlord. However, if you take the time to educate yourself on the nuances of property management, you can do very well for yourself. Over the short term, an index fund is subject to the whims of the greater market and world events that are out of your control. Why I still like index funds: Over the long term, the stock market has created tremendous wealth.

The solution to dealing with short term fluctuations is simply to ignore them. A big dip in the markets is nothing more than an opportunity to buy in at a lower cost. Ignore the news and stay the course. The losses are on paper; you only actually lose money when you sell for a lower price than you bought. Can you tell that 3 big bad black swans showed up? I love the diversification that owning both assets brings. Where you decide to deploy your money largely depends on your temperament.

Real estate requires more work, but can be a quicker path to wealth. However, I encourage you to explore both. Never forget that the end goal is financial independence. Stop every once in a while to smell the roses and hopefully not illegal cats in your rental. Work and save aggressively, knowing that a life without the worries of money is a good life. When not thinking about numbers and dollar signs, you can find him with his family playing in the beautiful outdoors of Colorado.

Real estate is a little more difficult getting into and time consuming. While not in RE, I did make a sizeable investment in a small business venture with my three brothers two of whom are active in the daily management.

Thank you for contrasting the difference of real estate investment and stock market investing!

Which Is A Better Investment: Real Estate Or Stocks? | Financial Samurai

Self-storage Investing has attracted me instead. Stocks — too much to think about. Index funds sounds good. I love real estate but will also invest in mutual funds for diversification. How should you invest when the market is at all-time highs? How about when the market is crashing. Can't figure out the difference between an ETF vs mutual fund?

The Money Wizard is here to help Learn about how tax loss harvesting works, how much it can save you on your taxes, and how to use it If you're reading this, you probably know that its important to invest early to let compound interest work its magic. Warren Buffett was recently asked what investing advice he'd give to Lebron James.

The advice he gave was so simple, anyone Anyone can be a successful investor during a bull market. But stock market corrections and bear markets are where big mistakes I'd rather continue struggling with my finances.

7 Ways to Build Financial Wealth | Rich Dad Coaching

Learn how to make better choices that compound into long term wealth. Where should we send you FREE actionable wealth-building advice? How to Start in Rental Properties How to Start Flipping Houses How to Invest in Real Estate Remotely How To Get a Mortgage Mortgage Basics Types of Mortgage Loans How To Get The Best Mortgage Rate Mortgage Application Process Table of Contents Real Estate Crowdfunding Fundrise Review RealtyShares Review RealtyMogul Review Patch of Land Review View All Real Estate Crowdfunding Platforms Real Estate Calculators Early Mortgage Payoff Calculator Credit Credit Cards Best Business Credit Cards Best Travel Credit Cards Best Student Credit Cards Best Balance Transfer Credit Cards Best Cash Back Credit Cards Personal Loans SoFi Review Earnest Review LightStream Review View All Personal Loans Credit Calculators Debt Snowball Calculator About Contact.

How I Learned To Stop Stock Picking And Love Index Funds. Our Average Net Worth By Age: How Do You Compare?

Related Items financial independence real estate Stock market. The Green Swan March 17, at 8: Aramis Realty March 27, at 3: April 4, at 4: Frugal Asian Finance April 12, at 9: The Stock Market Is Near All-Time Highs Or Crashing! How To Invest A Million Dollars. How To Invest Money Wisely With Little Money. How To Decide Between An ETF Or Mutual Fund? Why Tax Loss Harvesting Should Be Part Of Your Tax-Efficient Investing Strategy.

How Much Should I Have In My k At My Age? Should I Pay Off My Mortgage Early? How To Start Investing In Rental Property. What Is The Average Rate Of Return On A k? How Much Should I Have Saved For Retirement At My Age? More in Index Investing.

How To Invest A Million Dollars A millionaire shares how he would invest a million dollars if he could start over. How To Invest Money Wisely With Little Money How do you learn to invest money wisely when you have little money to start with? My Money Wizard April 24, My Money Wizard February 20, Why Tax Loss Harvesting Should Be Part Of Your Tax-Efficient Investing Strategy Learn about how tax loss harvesting works, how much it can save you on your taxes, and how to use it Eric Rosenberg January 6, John Schmoll February 24, Nate January 11, All information on InvestmentZen.

InvestmentZen has financial relationships with some of the products and services mentioned and may be compensated if consumers choose to sign up for products through links in our content.

Home News ZenAnswers Data Visualizations Personal Finance Top List Gallery Contributors Terms of Service Privacy Policy About Contact. Want To Build Long Term Wealth? Let us show you how YES, I WANT TO BUILD LONG TERM WEALTH. YES, SHOW ME HOW. NO, I HAVE ENOUGH MONEY. Get FREE Wealth-Building Lessons.