Rrsp investment options cra

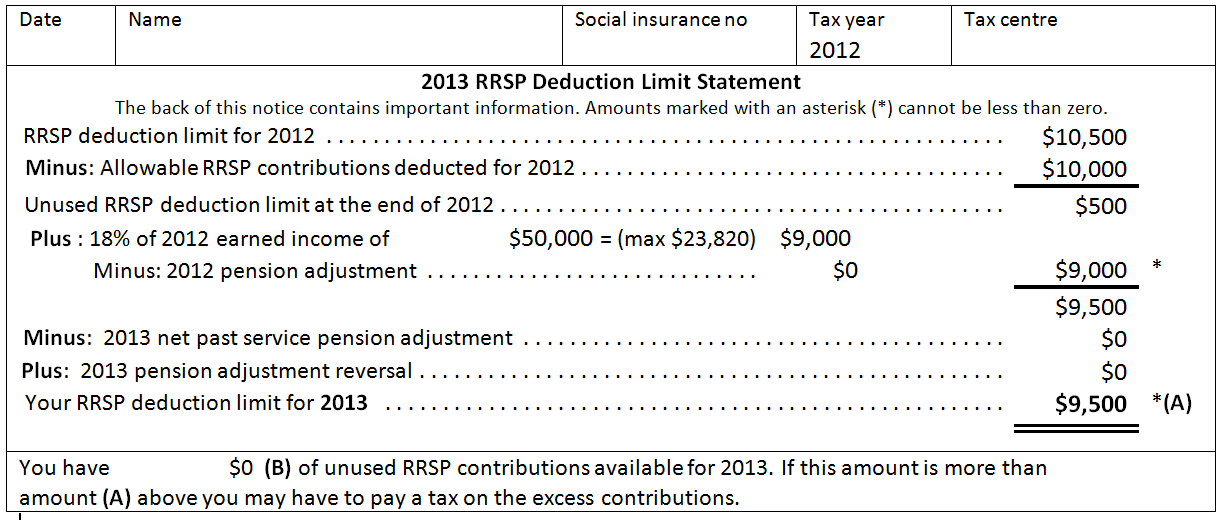

Line – RRSP and PRPP deduction

You have to transfer certain payments directly. To make sure that these funds are transferred on a tax-deferred basis, you must ask the payer to transfer the funds directly. Generally, amounts you transfer directly to your RRSP do not affect your RRSP deduction limit.

However, you may need to include an amount in income and claim an offsetting deduction. If you transfer the amount to your RRSP, you must be 71 or younger at the end of the year in which you transfer the funds.

unyyozeqy.web.fc2.com - RRSP, RRIF, RESP, RDSP and TFSA Qualified Investments, US Dollar Registered Accounts

For more information, see RRSP options when you turn Site menu Individuals and families Businesses Charities and giving Representatives.

Home Individuals and families RRSPs and related plans RRSP Transferring.

Transferring retiring allowances severance pay Amounts paid from an RRSP or RRIF upon the death of an annuitant Registered pension plan RPP lump-sum payments Deferred profit sharing plan DPSP lump-sum payments Commutation payments from your RRSP Property from an unmatured RRSP Registered Retirement Income Fund RRIF - Transfer of excess amounts and property Specified pension plan SPP lump-sum payments Pooled registered pension plan PRPP transfers.

Site Information Terms and conditions Transparency About About the CRA Careers at the CRA Corporate reports Mission, vision, and values Compliance Site map Contact information Enquiries Our offices Voluntary disclosures Informant leads Complaints and disputes News Newsroom News releases Speeches Tax tips Convictions Video gallery Stay connected Twitter YouTube Mobile apps Email lists RSS feeds.

Government of Canada footer Health Travel Service Canada Jobs Economy Canada.