Black scholes model options pricing

Definition of 'Black-scholes Model' - The Economic Times

Never miss a great news story! Get instant notifications from Economic Times Allow Not now. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. In the case of an MBO, the current.

QIP or Qualified Institutional Placement is largely a fund raising tool for the listed companies. QIP is a process which was introduced by SEBI so as to enable the listed companies to raise finance through the issue of securities to qualified institutional buyers QIBs. Earlier, since raising finance in the domestic market involved a lot of complications, Indian companies used to.

Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities a.

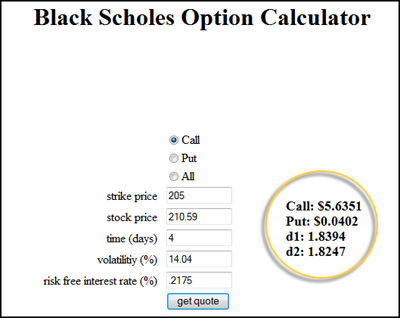

Black-Scholes is a pricing model used to determine the fair price or theoretical value for a call or a put option based on six variables such as volatility, type of option, underlying stock price, time, strike price, and risk-free rate. The quantum of speculation is more in case of stock market derivatives, and hence proper pricing of options eliminates the opportunity for any arbitrage. Required Rate of return is the minimum acceptable return on investment sought by individuals or companies considering an investment opportunity.

Investors across the world use the required rate of return to calculate the minimum return they would accept on an investment, after taking into consideration all available options. When calculating the required rate of return, investors lo. Prices of commodities, securities and stocks fluctuate frequently, recording highest and lowest figures at different points of time in the market. It is an important parameter for investors as they compare the current tradi.

For raising funds, it is not always preferable or feasible for a company to issue securities to the public at large as it is time consuming as well as an expensive option.

In such situations, the securities can be offered to a comparatively sm.

Basis Risk is a type of systematic risk that arises where perfect hedging is not possible. Basis is simply the relationship between the cash price and future price of an underlying. Net worth is the difference between the asset and the liability of an individual or a company. A high net worth relates to good financial strength and ultimately good credit rating of an individual or a company.

Similarly a low or negative net worth will relate to a weaker financial strength and a lower credit rating, thus directly affecting the individual's or the company's ability. Insider trading is defined as a malpractice wherein trade of a company's securities is undertaken by people who by virtue of their work have access to the otherwise non public information which can be crucial for making investment decisions.

Choose your reason below and click on the Report button.

This will alert our moderators to take action. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. ET APPS ET Android App ET iPhone App ET iPad App ET Wealth Android App ET Blackberry App ET Nokia App ET Markets Android App ET Markets iPhone App ET Money Android App.

FOLLOW US FACEBOOK TWITTER YOUTUBE LINKEDIN GOOGLE PLUS RSS. LATEST NEWS Decoding the 'soft coup' that makes Mohammed bin Salman the most powerful man in Saudi Arabia.

Tech TECH Hardware Software Internet ITeS Do Big Stories FOLLOW TECH. Most Apple 'leaks' coming directly from its employees: Magazines Panache ET Magazine Wealth Brand Equity Financial Times Travel FOLLOW PANACHE. More Newsletters Alerts E-Paper E-Learning ET intelligence Mobile ET Android App ET iPhone App ET iPad App ET Wealth for iPad ET Blackberry App ET Nokia App ET Markets Android App ET Markets iPhone App ET Money Android App. Samsung QLED The Next Innovation in TV.

For The Next India Committed to the Future, Committed to India. ET EnergyWorld A one stop platform that caters to the pulse of the pulsating energy. ET HealthWorld A one stop platform that caters to the pulse of the pulsating healthcare ET TOOL Online financial calculators and more. GST Latest news and analysis on GST. ET Portfolio Manage and grow your money smartly with just one tool. NIFTY 50 9, Select Portfolio and Asset Combination for Display on Market Band.

Black-Scholes: Robert Merton on the Options Pricing Model - Bloomberg

Download ET MARKETS APP. Drag according to your convenience. Categories Glossary Economy Equity Insurance Budget Marketing Mutual Fund Space Technology Testing Human Resource Finance Real Estate Security Sports Commodity Software Development Analytics HR Entertainment Retail Shipping Astronomy Transportation Education Mathematics.

Subscribe for Newsletters Subscribe.

Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. Binary Options A binary option is a type of derivative option where a trader makes a bet on the price movement of an underlying asset in near future for a fixed amount.

Block Deal Block deal is a single transaction, of a minimum quantity of five lakh shares or a minimum value of Rs 5 crore, between two parties. There are two important models for option pricing - Binomial Model and Black-Scholes Model.

The model is used to determine the price of a European call option, which simply means that the option can only be exercised on the expiration date. Black-Scholes pricing model is largely used by option traders who buy options that are priced under the formula calculated value, and sell options that are priced higher than the Black-Schole calculated value 1. The formula for computing option price is as under 2: Not to be Missed Why the Indian Insolvency and Bankruptcy code will not solve the problem of bad loans.

Companies may lose their registration if they fail to pass GST benefits to you. Hiding your 'true' identity at work may harm your career significantly. Join experts as they discuss the essentials of GST in Bengaluru. Rumour mills abuzz with improved design and display. Why you must buy Samsung QLED TV?

Option Pricing Models (Black-Scholes & Binomial) | Hoadley

Digg Google Bookmarks StumbleUpon Reddit Newsvine Live Bookmarks Technorati Yahoo Bookmarks Blogmarks Del. My Saved Definitions Sign in Sign up. Find this comment offensive? This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

Your Reason has been Reported to the admin. Living and entertainment Timescity iDiva Zoom Luxpresso Gaana Happytrips Cricbuzz Get Smartapp Networking itimes MensXP. Hot on the Web UBER OnePlus 5 Top 10 mutual funds GST Sensex Gold rate today Sensex Today. Services ads2book Gadgetsnow Free Business Listings Simplymarry Astrospeak Timesjobs Magicbricks Zigwheels Timesdeal dineout Filmipop Remit2india Gaana Greetzap Techradar Alivear Google Play Manage Notifications.