Disqualified disposition incentive stock options

A recent Chief Counsel advice CCA provides guidance on disqualifying dispositions of incentive stock options ISOs in reorganizations. The holder of an ISO that meets the requirements of Sec. Correspondingly, an employer does not receive a deduction when the ISO is exercised.

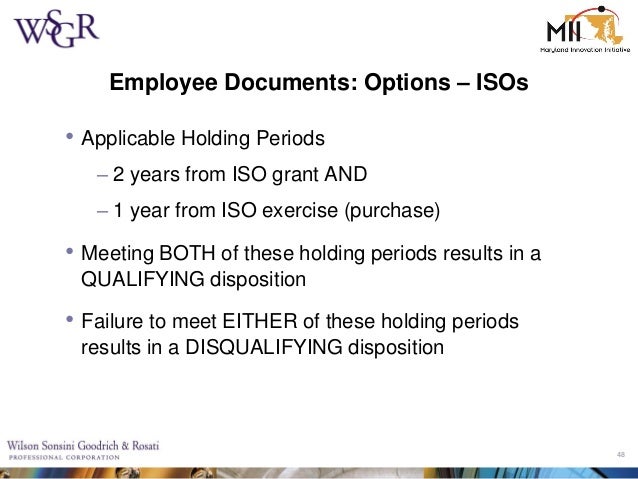

If stock acquired by exercise of the ISO ISO stock is held until the later of one year from the date the option is exercised or two years from the date the option is granted, any gain on the disposition of the ISO stock is entitled to be treated as long - term capital gain Sec. A disposition generally includes a sale, exchange, gift, or transfer of legal title, but it does not include a transfer from a decedent to an estate or a transfer by bequest or inheritance; an exchange to which Sec.

If the ISO stock is disposed of before the holding period is met, it is a "disqualifying disposition" Sec.

Dispositions of ESPP Stock

However, the wages are not subject to Federal Insurance Contributions Act taxes, Federal Unemployment Tax Act taxes, or wage withholding.

CCA explored the application of the disqualifying disposition rules in two scenarios: Scenario 1 involves a transaction that qualified as a Sec. The following is from the CCA: Corporation X and Corporation Y are unrelated corporations that are incorporated under the laws of State B. On July 1, , Corporation X grants a stock option to A , an employee of Corporation X since Jan.

The stock option qualifies as an ISO, as defined in Sec. The exchange does not have the effect of the distribution of a dividend under Sec. The stock of Corporation Z will be converted into voting common stock of Corporation X. Corporation Z merges into Corporation X in a transaction that qualifies as a reorganization described in Sec.

Following the merger, Corporation X continues in existence as a wholly owned subsidiary of Corporation Y.

How Incentive Stock Options are Taxed

The transaction does not meet the requirements of Sec. As a result, the transaction does not qualify as a reorganization under Sec. A discussion of whether the boot constitutes capital gain or a dividend under Sec.

The receipt of acquirer stock and boot in a Sec. The stock received in the reorganization steps into the shoes of the original ISO stock for purposes of the disqualifying disposition rules Sec.

The transaction fails to qualify as a reorganization under Sec. Rather, the exchange of ISO stock for stock and cash is a taxable exchange under Sec. The W - 2 income from the disqualifying disposition is based on the excess of the FMV of the stock over the exercise price on the date exercised.

W-2 and Disqualifying Dispositions

If there is a Sec. In Scenario 1, an employee's disposition of stock on Aug.

Early Disposition of ISO Stock

However, had the employee sold all of his or her stock on Nov. For additional information about these items, contact Mr. Wagner at or howard.

Keeping client information safe in an age of scams and security threats. Free Tax Insider newsletter.

Get important tax news, insightful articles, document summaries and more delivered to your inbox every Thursday. Tax Section membership will help you stay up to date and make your practice more efficient.

Toggle search Toggle navigation. Dealing With ISOs and Disqualifying Dispositions in Reorganizations By Carl P.

TOPICS C Corporation Income Taxation Reorganizations. SPONSORED REPORT Keeping client information safe in an age of scams and security threats A look at the Dirty Dozen tax scams and ways to protect taxpayer information.

SUBSCRIBE Free Tax Insider newsletter Get important tax news, insightful articles, document summaries and more delivered to your inbox every Thursday. Connect The Tax Adviser on Twitter AICPA Tax Practitioners on Linkedin.