Asian options pricing excel

A cynical look at our financial markets and the governments that support them.

The Asian option payoff depends on the average price of the underlying asset over a specific period of time. The expected payoff of an Asian option is less than the expected payoff of a European option and is therefore much cheaper. On the plus side, the Asian option takes away some of the point of time risks embedded in European options and allow for more stable payoffs.

London Metal Exchange: Historical data

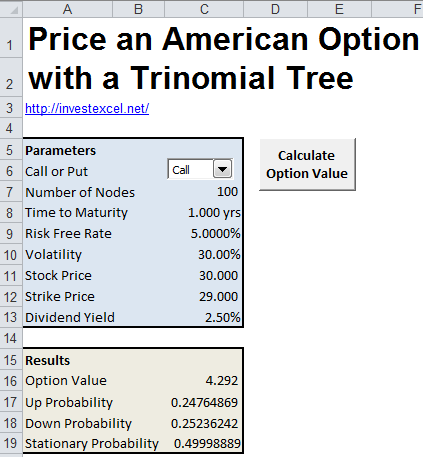

The problem with Asian options and most exotic options is that the option price cannot be calculated by simply plugging numbers into the Black-Scholes equation because the payoff depends on the path that the stock price takes until the maturity of the option. The first way to calculate the price is to use a binomial or trinomial tree , but the speed of computers and flexibility of implementation has made monte carlo simulations the more practical method for pricing.

For those of you who are interested in learning how to price an exotic option using Monte Carlo simulations, I have produced an excel spreasheet with modifiable code that is for sale:.

Price Arithmetic and Geometric Asian Options with Monte Carlo Simulations through an Excel VBA Macro.

Finance Add-in for Excel | Hoadley

Posted in Derivatives , Educational. Tagged with asian option pricing , asian option.

Car Database - make, model, full specifications in Excel format

By SurlyTrader — April 9, Stay in touch with the conversation, subscribe to the RSS feed for comments on this post. Leave a Reply Cancel Some HTML is OK. Email required, but never shared. Notify me of follow-up comments via e-mail.

Pricing Asian Options | SurlyTrader

Buy the print book in color and get the Kindle version for free along with all examples in a spreadsheet tutorial! Proudly powered by WordPress and Carrington. SurlyTrader A cynical look at our financial markets and the governments that support them Books About Option Blogs Disclaimer Log in. Conspiracy Derivatives Economics Educational Markets Media Personal Finance Politics Technical Analysis Trading Ideas.

Call Options Example: Black-Scholes Implemented using ExcelIs a Correction in Gold Coming? Leave a Reply Cancel Some HTML is OK Name required Email required, but never shared Web or, reply to this post via trackback.

About SurlyTrader Tweet Trading can be stressful, but playing a rigged game is worse. SurlyTrader will explore the hidden game of financial institutions and the government that supports them while providing useful tips on trading strategies, hedging and personal finance.

SurlyTrader is a portfolio manager at a large financial institution who specializes in trading derivatives. Support the Blog Voluntary Donation for the Blog. Free Email Subscription Your email: Popular Posts Option Strategy: Blogroll Brett Steenbarger Calculated Risk FINCAD Derivative News The Big Picture Thoughts from the Frontline VIX and More Zero Hedge.

Archives June March February January December November October August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July