Alligator trading strategy

If you are a fan of trading with moving averages and unfamiliar with the alligator indicator , get ready for a pleasant surprise.

In this article, we are going to do a head-to-head comparison of the Alligator indicator with the triple EMA TEMA to see which one comes out on top. The Alligator indicator is an on-chart trading tool created by famous trader and author Bill Williams. The Alligator is used to confirm ongoing trends and their primary direction. In addition to identifying existing trends, seasoned traders also use the alligator indicator to enter counter trend moves.

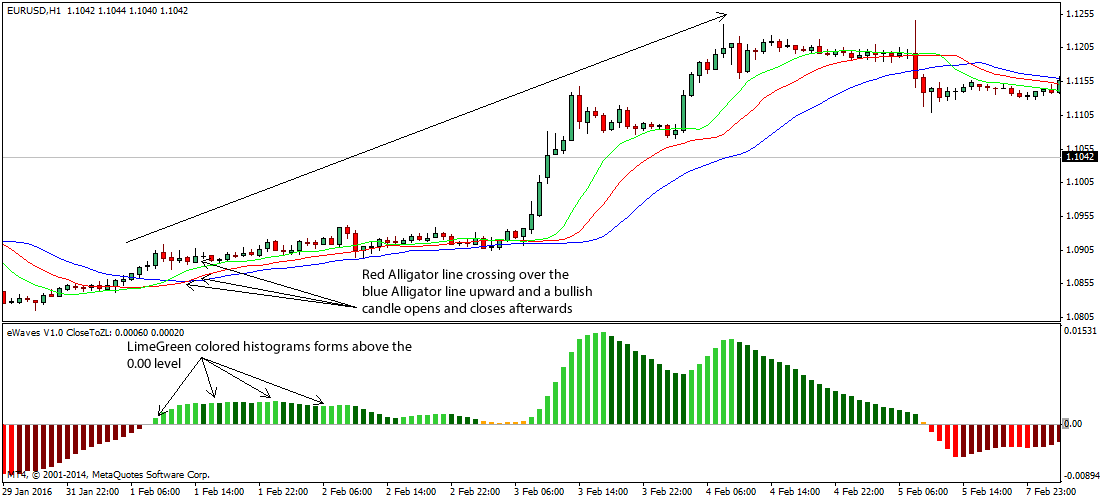

The Alligator consists of three moving averages. Note these moving averages are not just SMAs or EMAs; the secret behind the Alligator is a bit more complex. The Alligator indicator has three lines — green, red, and blue.

The green line tracks closest to the price action , the red line is the middle average and the blue line is the furthest from the price action. The above is the default Bill Williams Alligator settings, which of course can be configured to meet any trading style.

Exploring The Williams Alligator Indicator (AAPL, EUR/USD) | Investopedia

The signs of a sleeping Alligator are when the three lines are close to each other. This of course translates to low volatility and trading should be avoided during these lull periods.

Forex Tester 3: trading simulator for backtesting. Best training software that will backtest your strategies. A prediction app for learning on how to trade on the currency market

Usually, this is the time when the lips of the Alligator green line cross the teeth red line and the jaws blue line. If the lips cross the other two lines in an upwards fashion, we have an awakening bullish Alligator. If the lips cross the other lines in a downward fashion, we have an awakening bearish Alligator.

The Alligator could start eating after waking up. The signal for a hungry Alligator is after the completion of the waking up stage, a candle closes below or above the three lines.

This is when we should go long or short respectively. The pink circles show us when the Alligator is attempting to wake up.

How to Use Alligator Indicator in Forex Strategies - ForexBoat Trading Academy

In these moments, we should prepare ourselves for a long position. When the distance between the lines begins to expand and we see a bullish candle closing above the Alligator teeth and jaws, we go long. The triple exponential moving average, also known as the TEMA, is a single line configuration on the chart. It smoothes the price of the equity three times using an EMA formula and then calculates the change in the EMAs based on the result for the previous day n Traders use the TEMA to enter and manage trades during strong trending markets.

Conversely, the TEMA is not a great tool when the market is ranging, since it provides many fake signals. The TEMA line can easily be mistaken for one of the many moving average indicators.

You may be thinking: This is a minute chart of Intel from Sep , As you can see, the TEMA bounces above and beneath the price action. The thing that may not be apparent on the chart is the TEMA reduces lag usually created by the other moving averages. Notice that the lag of the TEMA is significantly less when compared to that of the standard EMA. The reason for this can be found within the formula of the TEMA. In life, more complexity does not always lead to better results, but in the case of the TEMA versus the EMA, this may be the outlier.

This of course also leads to further lagging in the trading signals. Thus, be careful when configuring the TEMA as the volatility and the time frame should also be taken into consideration. The tighter your TEMA, the more fake signals you will encounter on the chart.

In terms of signals, the TEMA acts the same way as a standard moving average. When the price breaks the TEMA upwards, a long signal is generated. When the price breaks the TEMA in a bearish direction, a short signal is generated. Above is a minutes chart of Bank of America from Sep , Here I used a period TEMA configuration. This is the time you should remember when I said that the TEMA strives to identify rapid market movements, but at the same time fails during ranging markets.

We applied a period TEMA to the chart and we get the following results:. What we did not show in the above example are the commission savings you would have racked up by using the Alligator indicator. Of course, one trading example is not enough data to declare victory; however, reducing the noise, less commissions and the fact the Alligator can stand on its own is more than enough reasons to rank it above the TEMA.

Learn to Day Trade 7x Faster Than Everyone Else Learn How. Free Trial Log In. Alligator Indicator versus the Triple EMA. Triple Exponential Moving Average. Too Many TEMA Trading Signals. Broad Market Indicators for Day Trading.

Best Day Trading Chart Indicators.

How to Day Trade with the Triple Exponential Moving Average TEMA. How to Trade Volatility. Categories Candlesticks Chart Patterns Day Trading Basics Day Trading Indicators Day Trading Psychology Day Trading Software Day Trading Strategies Day Trading Videos Futures Glossary Infographics Investment Articles Swing Trading Trading Strategies. Customer Login Sign Up Contact Us. Login Sign Up Contact Us.