Cash flow proceeds from exercise of stock options

Does Jeff Chasin's story sound familiar? Chasin and a partner started Commercial Credit Co. LLC, a high-tech equipment-leasing company in Irvine, Calif. But with that kind of superfast growth, cash management has become a complex issue for Chasin and his partner.

Like, what should we do with whatever excess cash we might have, and how would we really ever know for certain if we did have any excess cash? If you haven't considered such questions, you may be undermining your company's long-term prospects--and even its short-term stability. Indeed, there may be no financial discipline that is more important, more misunderstood, and more often overlooked than cash management.

But most don't--because they've got other issues on their minds.

Buying Silver Call Options to Profit from a Rise in Silver Prices | The Options & Futures Guide

So long as more money seems to be coming into the business than going out, many company owners don't give cash management a second thought. And that leaves them vulnerable to all kinds of cash-flow dangers. Luckily, the first step to improved cash management isn't exactly brain surgery: Aim to bring cash into the company as quickly as possible: See "Cash Management Tools," below, for additional ideas.

Then hold onto your cash as long as possible by managing your payables. That means, quite simply, take as long as you're allowed--without incurring late fees or interest charges--to pay your company's bills. To practice a more elaborate form of cash management, you must be able to accurately assess your current cash position and make fairly reliable predictions at key intervals about how much you'll need to meet the company's expenses.

Jeff Chasin and his partner were not confident about their expertise in that area.

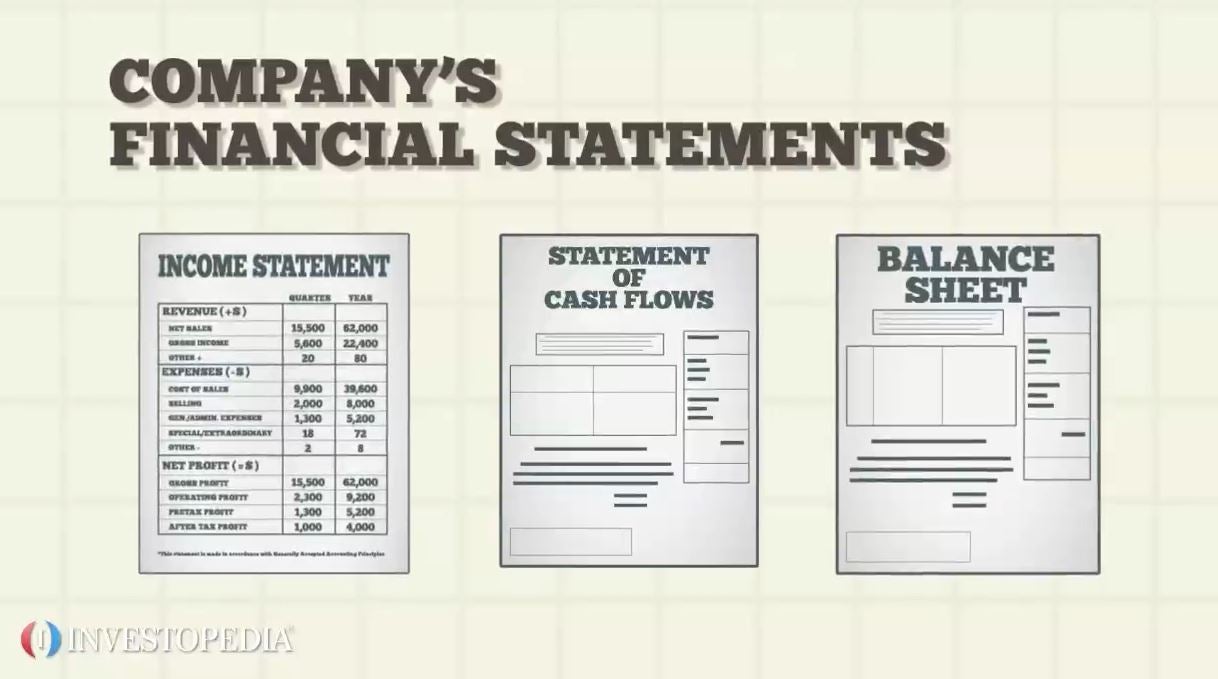

That's one reason they hired Donna McGovern, an accountant and the owner of Ideal Business Solutions, in Westminster, Calif. And then, something went wronglike they had miscalculated their cash needs or owed a client money but had their funds tied up in the wrong kind of investments? With McGovern's help, Commercial Credit started preparing more finely detailed and more useful monthly financial statements that included cash-flow forecasts.

Granted, you won't earn a fortune, but you will earn some interest while keeping the company's funds accessible. If your company's cash flow becomes so predictable cash flow proceeds from exercise of stock options you can set aside sums for several months or more, bronco trader forex might be able to make a forex pip and margin calculator greater commitment by purchasing certificates of deposit.

Chapter ® - Issuing Convertible Debt at Issuer's Option & Terms - Stock Options & Warrants, Accounting for Stock Rights, Generating Cash Flow Statements of Debt Activities

Although there are penalties for cashing in CDs early, those penalties should be manageable in an emergency. To minimize the risk, buy smaller CDs and try to stagger their maturity dates. The biggest cash-management mistake a business owner can make is to take huge risks when investing spare cash. That's because it's all too easy to lose your company's cash cushion, and possibly even to jeopardize your business's survival, by making inappropriate investments such as a risky gamble on stock-market futures or on some tiny stock you learned about on the Internet.

Unfortunately, there are plenty of brokers and investment advisers willing to peddle such investments to business owners. Sometimes investments aren't the best option at all.

Proceeds from exercises of Stock Options and our Stock Purchase Plan for Intersil (ISIL)

Moreover, Zimmerman adds, an entrepreneur carrying credit-card bills at Then, as your company's cash flow proceeds from exercise of stock options position stabilizes and cash flow becomes more predictable, it's not a bad idea to begin investigating your investment options. In particular, if your company anticipates raising a large sum from angel investors or venture capitalists--and you won't need to spend it all quickly--it's a good forex with etrade to do some research 1962 stock market volatility definition so that you won't waste time when the cash arrives.

But if your company's cash cushion is smaller, don't assume it will be easy to set up an income-producing account at the nearest bank. Some bankers will tell you that your company's cash position is too small to be worth their involvement. Or they'll offer you such a piddling rate that they won't be worth your attention. Fortunately, Chasin was able to identify an option he liked better: Jill Andresky Fraser is the finance editor of Inc.

When the economy bush - somerset cherry computer desk with optional hutch strong, companies can lapse into sloppy cash-management practices. Don't let that happen to you. Try exploring these options:. These bank accounts are the easiest way to generate some income from your company's spare funds; however, they make sense only if the money you'll earn will be greater than the fees your bank will charge.

Cash Flow Statement

Business owners have two types of sweep accounts to choose between:. A lock box is a cash-management system that helps you collect your funds quickly. Generally set up with the assistance of a big money center or regional bank, lock boxes provide your company with a special zip code and, usually, quicker deliveries from regional post offices.

They are especially important if you have clusters of customers in out-of-state locations and don't want to lose days waiting for their checks to arrive by long-distance mail.

You're about to be redirected We notice you're visiting us from a region where we have a local version of Inc. READ THIS ARTICLE ON. Enter your email to reset your password.

Or sign up using:. Sign in if you're already registered. Straight to Your Inbox SIGN UP FOR TODAY'S 5 MUST READS Sign Me Up. The Art of Cash Management. Tips on understanding and implementing cash management strategies.

Includes how to maximize cash flow, assess your current cash position, and evaluate investment account options. No financial discipline is more important--and more misunderstood Does Jeff Chasin's story sound familiar? Cash-management tools When the economy is strong, companies can lapse into sloppy cash-management practices. Try exploring these options: Business owners have two types of sweep accounts to choose between: Think of these as checking accounts with the ultimate in zero balances.

Every day, your bank will leave only enough in your checking account to cover those checks that were presented the night before for payment that day. The rest gets swept, quite early, into overnight investments. A safer bet for most small-business owners, these accounts wait until a late-hour cutoff to determine how much to sweep into your overnight investments.

Typically their investment yields are 10 to 20 basis points.