Telecom nz shares asx

Rick Mooney June 10, More on: There has been a lot of activity in the telecommunications sector recently.

IIN by TPG Telecom Ltd. AMM make a period of uncertainty in the sector likely for some time to come. SPK may offer an opportunity for investment with a dominant business in its market. Spark New Zealand Limited formerly Telecom Corporation of New Zealand Limited is a telecommunications service provider, offering a range of….

Enter your email below for FREE access to this article and all the content on the site. Also receive Take Stock, The Motley Fool's unique daily email on what's really happening with the share market. You may unsubscribe any time. By clicking this button, you agree to our Terms of Service and Privacy Policy. We will use your email address only to keep you informed about other products and services we think might interest you.

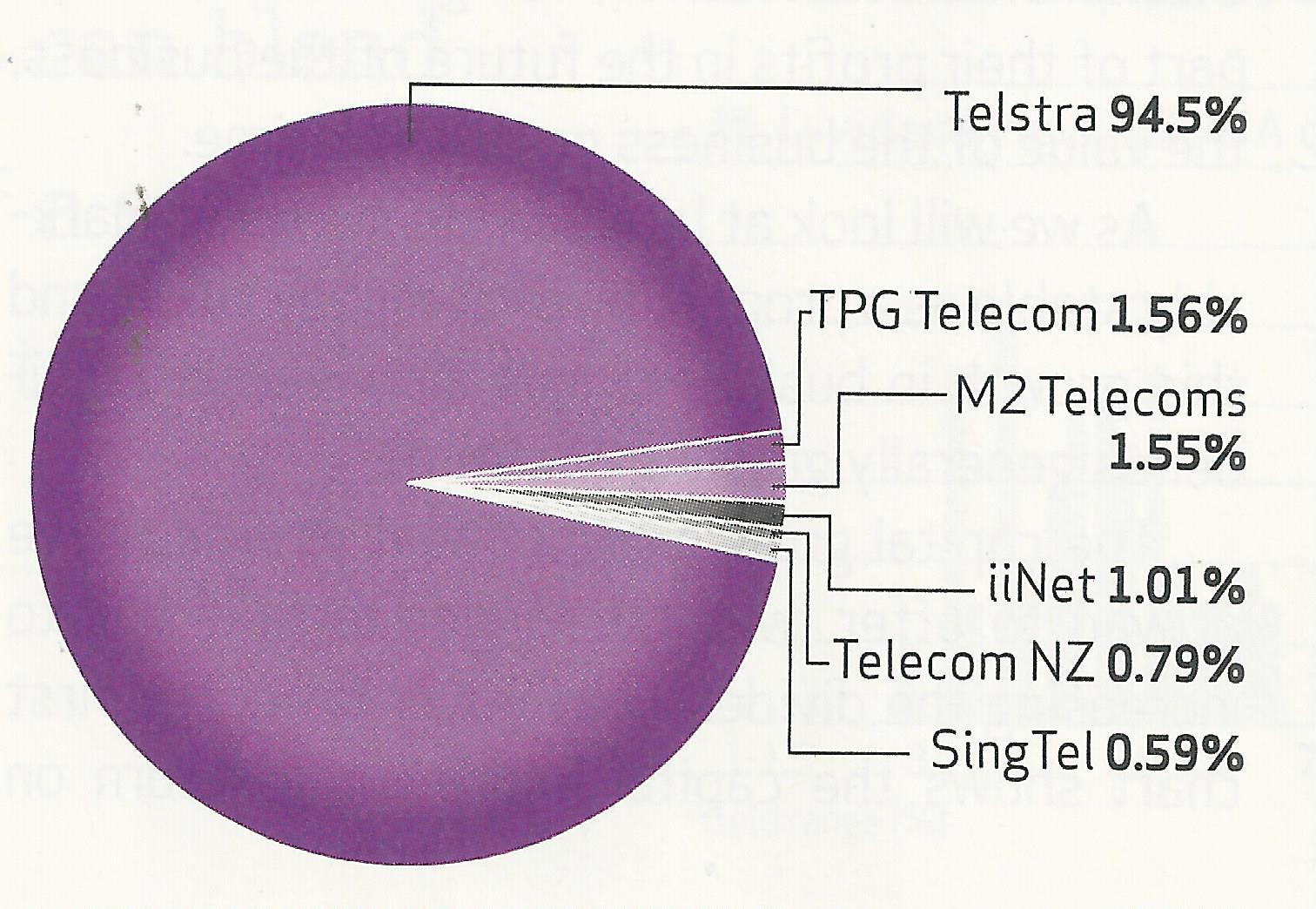

Please read our Financial Services Guide FSG for more information. The takeover of iiNet Limited ASX: IIN by TPG Telecom Ltd ASX: TPM as well as the proposed merger between Vocus Communications Limited ASX: VOC and Amcom Telecommunications Limited ASX: Spark New Zealand Limited formerly Telecom Corporation of New Zealand Limited is a telecommunications service provider, offering a range of services and products to consumers and businesses in New Zealand.

Telecom New Zealand (ASX: TEL) | Motley Fool Australia

It is the largest internet service provider and second-largest mobile provider behind Vodafone. Spark New Zealand has gone through a period of restructuring, including divesting its holding in AAPT Limited and winding down its IT business in Australia. It has also announced an intention to sell its interest in Telecom Cook Islands. Its price-to-earnings ratio of Because Spark operates outside of Australia, the dividends are unfranked, but at a yield of 6.

The return on invested capital and return on equity are both satisfactory at 16 and 19 respectively. The equity valuation-to-earnings ratio is It is much lower than the reported earnings per share and as a result, my calculations for intrinsic value based on cash flow are significantly lower than the current price. This is largely a result of the high capital expenditure required to maintain and develop infrastructure in the telecommunications sector.

By my calculations, Spark New Zealand is trading above fair value. The Australian Financial Review says "good quality Australian shares that have a long history of paying dividends are a real alternative to a term deposit. Click here now to find out the names, stock symbols, and full research for three of our favourite income ideas, all completely free! Motley Fool contributor Rick Mooney has no position in any stocks mentioned.

The Motley Fool Australia has no position in any of the stocks mentioned.

INVESTING IN THE SHARE MARKETWe Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

The Motley Fool has a disclosure policy. This article contains general investment advice only under AFSL Authorised by Bruce Jackson.

And all you have to do to discover the name, code and a full analysis is enter your email below! We will use your email address only to keep you informed about updates to our website and about other products and services we think might interest you. You can unsubscribe from Take Stock at anytime.

Telecom Corp Of New Zealand (ASX:TEL) - Share Price and Dividend Yield - Intelligent Investor

Please refer to our Financial Services Guide FSG for more information. What's REALLY going on in the share market Discover our experts' take on the ASX with your FREE subscription to The Motley Fool Australia's weekly email Take Stock Financial Services Guide Privacy Policy Terms of Service Subscription Terms of Service. Is Spark New Zealand Ltd good value?

SPK There has been a lot of activity in the telecommunications sector recently.

To keep reading, enter your email address or login below. HOT OFF THE PRESSES: My 1 Dividend Pick for ! Enter your email address below to activate your FREE subscription now! Home Compare Services Share Advisor Dividend Investor Extreme Opportunities Hidden Gems Million Dollar Portfolio Pro Everlasting Income Lakehouse Capital.

Financial Services Guide Privacy Policy Terms of Service Subscription Terms of Service ACN: