Nqso stock options

The following is a quick reference guide to the awards and grants that you may receieve as part of your equity compensation plan. Restricted Stock Awards are generally subject to sale restrictions, and you may not sell the shares until the restrictions are lifted typically, until a vesting event occurs. You may also risk forfeiture of the shares until certain vesting targets are met, such as employment length or stock performance. Restricted Stock Shares are awards that entitle you to ownership rights including voting and dividend rights in your company's stock.

During the restricted period, you may have voting rights and the right to dividends paid on the restricted shares, which may be paid to you in cash or reinvested in additional restricted shares. Once vested, the Restricted Stock Shares are usually no longer subject to restriction.

Generally, an award of Restricted Stock Units entitles you to stock or cash with a value equal to the number of units awarded upon vest. As a recipient of Restricted Stock Units, you usually have no dividend or voting rights until vest, since no shares are actually issued to you until that point. However, your company may choose to pay you a dividend equivalent. As with Restricted Stock Shares, Units are also subject to forfeiture prior to the vesting event.

Performance Stock Shares are restricted stock shares that vest upon the achievement of company-specified performance conditions. Performance measurements are set by your company. During the restricted period you may have voting rights and the right to dividends paid on the restricted shares, which may be paid to you in cash or may be reinvested in additional performance shares.

Once vested, the performance shares are usually no longer subject to restriction. Performance Share Units are restricted stock awards granted in units instead of actual shares. Each unit awarded usually represents the value of one share of stock.

Generally, an award of Performance Share Units entitles the recipient to stock or the cash equivalent upon vest.

As a recipient of Performance Share Units, you usually have no ownership or voting rights until vest, since no shares are actually issued to you until that point. Performance Share Units are usually subject to risk of forfeiture until a specific performance measurement is satisfied. A Stock Option is the right, but not the obligation, to purchase a company's stock at a fixed price for a fixed period of time.

The primary difference between the two types of stock options—Non-Qualified Stock Options and Incentive Stock Options—lies in their tax treatment:. Please consult your local tax advisor for up-to-date tax regulations surrounding equity compensation. ISOs offer a tax incentive and are typically granted only to U. Incentive Stock Options ISOs have the following characteristics:. Once you have enrolled in the plan, your company will collect your payroll contributions to purchase shares on a specific date.

The shares are then deposited into an account at Morgan Stanley.

Non-Qualified Stock Options - TurboTax Tax Tips & Videos

Stock-settled Stock Appreciation Rights pay out the appreciation in the form of stock. You then have the option of keeping the stock or immediately selling the stock for cash. Cash-Settled Stock Appreciation Rights pay out the appreciation in the form of agnieszka kowalczyk forex. The cash payment is then paid through your company's payroll.

Understanding Your Stock Plan Awards. Information on this website is general in nature. It is not intended to cover the specific terms of your company's equity plan s. Getting Started with Your Stock Plan account Morgan Stanley Global Stock Plan Services. About Us StockPlan Connect Contact Us Favorites. Getting Started technique pour trader les options binaires Your Nqso stock options Plan account Managing Your Equity Awards Managing Your Wealth.

Non-Qualified Stock Option (NSO)

Glossary of Nqso stock options Plan Awards Glossary of Stock Plan Awards. Restricted Stock Awards entitle you to ownership rights in the company's stock. Restricted Stock Awards RSAs Restricted Stock Awards are generally subject to sale restrictions, and you may not sell the shares until the restrictions are lifted typically, until a vesting event occurs. Following are the various types of restricted stock awards that you may receive: Restricted Stock Shares RSSs Restricted Stock Shares are awards that entitle you to ownership rights including voting and dividend rights in your company's stock.

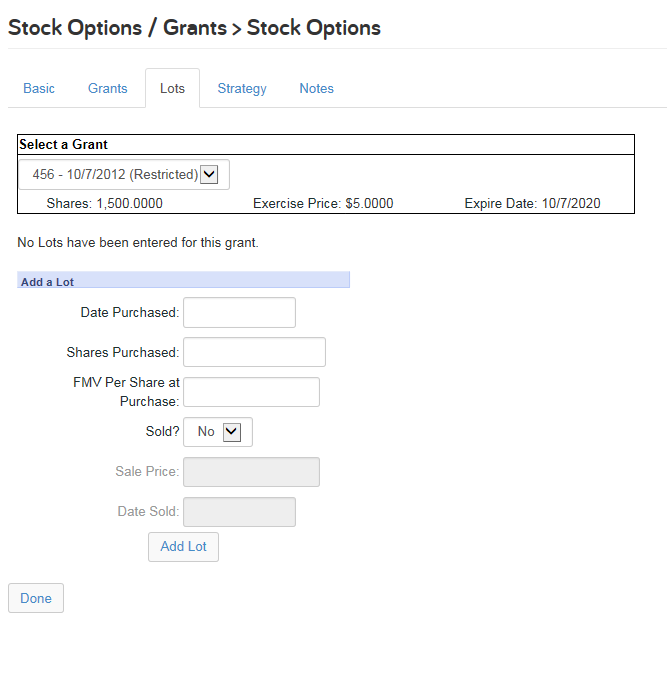

Performance Stock Shares PSSs Performance Stock Shares are restricted stock shares that vest upon the achievement of company-specified performance conditions. Performance Stock Units PSUs Performance Share Units are restricted stock awards granted in units instead of actual shares. Stock Options A Stock Option is the right, but not the obligation, to purchase a company's stock at a fixed price for a fixed period of time.

Non-Qualified Stock Option (NSO)

The primary difference between the two types of stock options—Non-Qualified Stock Options and Incentive Stock Options—lies in their tax treatment: Non-Qualified Stock Options NQSOs Non-Qualified Stock Options NQSOs have the following characteristics for U.

No income recognized and no taxes are due when NQSOs are granted. Income taxes are withheld at the time of exercise on the spread and reported on your W-2 in the year of exercise.

When you sell shares you purchased from an NQSO exercise, if the sale price is higher lower than the FMV at exercise, you will have a capital gain loss.

Incentive Stock Options ISOs ISOs offer a tax incentive and are typically granted only to U. Incentive Stock Options ISOs have the following characteristics: ISOs receive preferential tax treatment under the Internal Revenue Code. If the shares are held at least one year from the date of exercise and two years from the date of grant, any gain at sale will be taxed as capital gain rather than ordinary income.

If shares are sold prior to the required holding period, the sale will be deemed a disqualifying disposition and treated for tax purposes as an NQSO. No income is recognized and no taxes are due when ISOs are granted. When options are exercised, no taxes are due or withheld. Stock-Settled Stock Appreciation Rights SSARs Stock-settled Stock Appreciation Rights pay out the appreciation in the form of stock.

Cash-Settled Stock Appreciation Rights CSARs Cash-Settled Stock Appreciation Rights pay out the appreciation in the form of cash. See All Understanding Your Stock Plan Awards. Recommended Links Accepting Your Equity Awards and Grants Online Getting Started with StockPlan Connect Visit Stockplan Connect.