Best pullback trading strategy

The breakout and pullback trading strategies are two main ways to trade stocks. Swing traders, as well as day traders, use these two trading strategies every day.

How To Quickly Scan For Swing Trade Pullbacks

Sometimes you can wonder which method has a higher probability of success. Is it breakout strategy or is it a pullback trading system? The answer to this question is quite simple if you want to hear short version: It depends on the situation.

And there are times when it can be more profitable to trade breakouts. It pays a huge dividend of much easier and quicker profits if you trade in the direction of a major stock market trend. Trading volume is higher during periods of price advance than during smaller corrections. The decline during a bear market period is typically quick and intense. Corrections are small, if any.

You have to understand key characteristics of these two trading strategies to know which one to select for your next stock trade.

The energy for a breakout should accumulate before a break of a resistance level can happen for a bullish trade. The weakness of these trades is that the trade setup often leads to the more risky scenario that will affect your position sizing. The stop-loss level is typically larger than in a pullback trading strategy.

The breakout is a preferable trading style for a rising market.

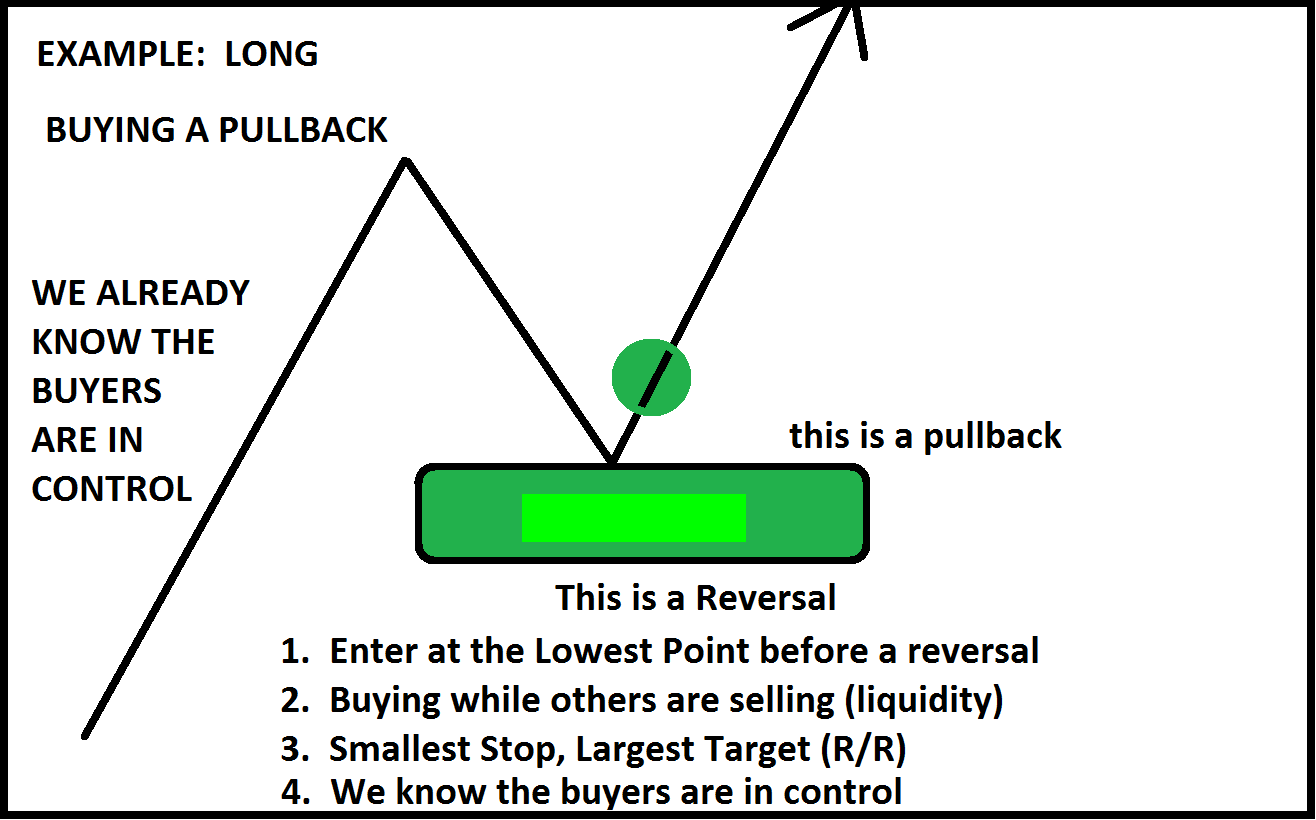

If your stock made a breakout already, and the price advances up for a bullish trade style , then prefer a pullback strategy. You can wait for a pullback to find a low-risk entry point.

Day Trading Strategies That Work - Day Trade Stocks

The move after a break can be very quick and push the price too far. Pullback trading offers many opportunities to make regular profits for swing, position, and day traders. It has its advantages, especially in:.

Home Start here Trading club Member Login Trading Club Trade Simple Stock Strategies. When to prefer a pullback trading strategy The breakout and pullback trading strategies are two main ways to trade stocks. Bearish stock market situation The decline during a bear market period is typically quick and intense.

When to trade breakout strategy You have to understand key characteristics of these two trading strategies to know which one to select for your next stock trade. When a pullback strategy has a better chance to generate huge profits If your stock made a breakout already, and the price advances up for a bullish trade style , then prefer a pullback strategy.

Pullback trading strategy summary Pullback trading offers many opportunities to make regular profits for swing, position, and day traders. It has its advantages, especially in: Find more on related pages Explore rules for a different stock market trend situation The most important retracement levels in chart analysis and for trading Read more about stock trading strategies that work. Be Better Trader Four Best Stock Screeners Stock Trading Club Stock Picking Course Simple Stock Trading System.

Learn This Swing Trading Exit Strategy

Latest articles What is the best moving average for pullback trading strategy? Top 4 ways to stay in online trading long enough to succeed Ways to identify bullish and bearish stocks Read your way from nothing to success in stock trading Understanding candlestick charts and patterns Stock Market Investing Tips.

Most popular Create Stock Trading Strategy Stock Chart Analysis Ideas for stock screeners ETF Trading Strategies. Chart reading Chart analysis Chart patterns Candlestick tutorial. Stock Trading Trading strategies Trading systems Stock screeners Daytrading.

ETF Trading ETF strategies ETF lists Trading tips.

Disclaimer Privacy Policy Affiliates Advertising About Contact me. C Copyright Richard Koza, Atwel International, s. This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.