Linear regression forex trading

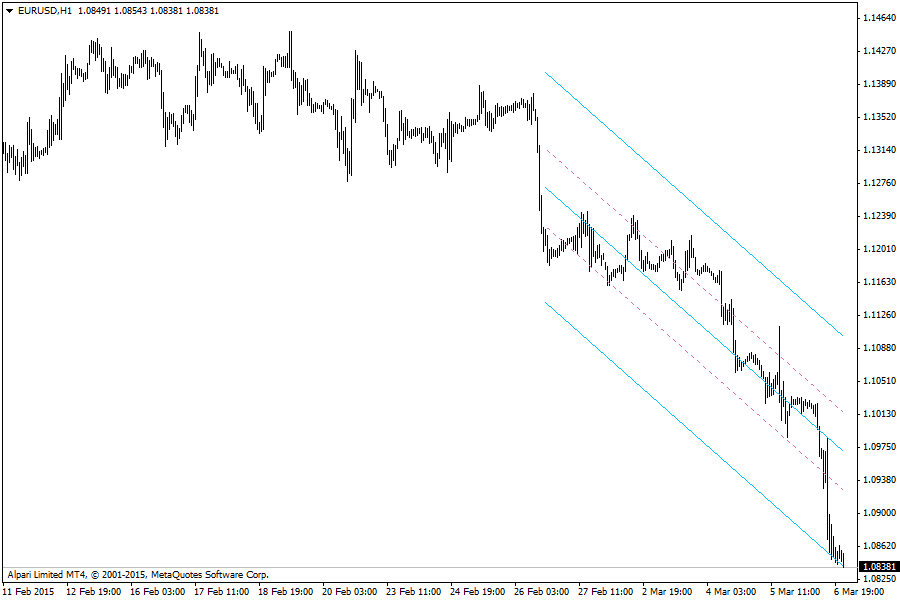

A Linear Regression Line is a straight line that best fits the prices between a starting price point and an ending price point. A "best fit" means that a line is constructed where there is the least amount of space between the price points and the actual Linear Regression Line.

The Linear Regression Line is mainly used to determine trend direction. Traders usually view the Linear Regression Line as the fair value price for the future, stock, or forex currency pair.

When prices deviate above or below, traders may expect prices to go back towards the Linear Regression Line. As a consequence, when prices are below the Linear Regression Line, this could be viewed by some traders as a good time to buy, and when prices are above the Linear Regression Line, a trader might sell.

Linear Regression Line - Technical Analysis

Of course other technical indicators would be used to confirm these inexact buy and sell signals. A useful technical analysis charting indicator that uses a Linear Regression Line is the Linear Regression Channel see: Linear Regression Channel , which gives more objective potential buy and sell signals based on price volatility.

The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Past performance is not necessarily an indication of future performance. Trading is inherently risky.

Home Technical Analysis Candlestick Charts Classic Charts Options. Trading Disclaimer Privacy Policy Contact Us.

Linear Regression Line Linear Regression Linear Regression Channel Linear Regression Line Linear Regression Curve.